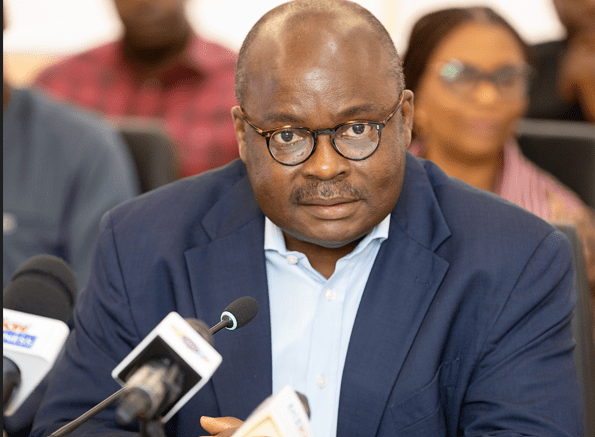

Exchange rate stability will be sustained – Governor Addison

Governor of the Bank of Ghana (BoG), Dr Ernest Addison has assured that the Cedis will gain strength against the major trading ones especially the dollar owing to the work that the central bank is doing.

“I am sure you know that the exchange rate stability will be sustained. “It is not possible to continue the disinflation process with exchange rates that are not stable, so implicit in that statement is to give assurance to you all about the stability of the cedi going forward.”

“I am aware that this morning for example, every bank has got a little bit of FX [foreign exchange] from the central bank. Averagely there one or two banks who didn’t need it but I am sure FBN [First Bank Ghana] got probably some of those resources”, Dr Addison he said at an event for Name change Galla Dinner for FBN Bank, in Accra on Thursday, May 2.

Regarding the banking sector, Addison served notice that the central bank would not hesitate to crack the whip on institutions involved in regulatory breaches.

As the regulator, he said, the Bank of Ghana is fully committed to remain vigilant in its oversight operations of all financial institutions in Ghana.

That notwithstanding , he said, banks have continued to breach guidelines that have been set to ensure that the Banking system remains safe and sound and free from all facets of financial crime including money laundering, fraud, terrorist financing, corruption, market manipulation, insider dealings and cybercrime.

“As the regulator, the Bank of Ghana is fully committed to remain vigilant in its oversight operations of all financial institutions in Ghana. Notwithstanding this, Banks have continued to breach guidelines that have been set to ensure that our banking system remains safe and sound and free from all facets of financial crime including money laundering, fraud, terrorist financing, corruption, market manipulation, insider dealings and cybercrime,” he said.

“Let me note that, to protect depositors, while ensuring the stability and soundness of the banking system, the Bank of Ghana will continue to be vigilant to ensure that banks comply with regulatory requirements and guidelines to build trust and confidence in our financial institutions,”

BANK OF GHANA’S HIGHER CASH RESERVE REQUIREMENT FOR COMMERCIAL BANKS IS COUNTERPRODUCTIVE – KWAKYE

He further stated that the banking sector operations and services are rapidly evolving, driven by financial technology advances.

The emergence of fintechs in the financial ecosystem, and their delivery of innovative financial products and services, he said, has rejuvenated the adoption and diffusion of technology in every sphere of banking sector operations, which have supported the financial inclusion agenda.