Some countries are reevaluating their heavy reliance on the dollar – IMF Dep. MD

First Deputy Managing Director of the International Monetary Fund (IMF), Gita Gopinath, has said that global economic ties are changing in ways that have never been seen since the end of the Cold War.

After years of shocks—including the COVID-19 pandemic and Russia’s invasion of Ukraine, she said, countries are reevaluating their trading partners based on economic and national security concerns.

Foreign direct investment flows are also being re-directed along geopolitical lines, she added.

Madam Gita Gopinath Some indicated that countries are reevaluating their heavy reliance on the dollar in their international transactions and reserve holdings.

“All of this is not necessarily bad. Given the recent history of events, policymakers are increasingly—and justifiably—focused on building economic resilience.

“But if the trend continues, we could see a broad retreat from global rules of engagement and, with it, a significant reversal of the gains from economic integration,” she said in an article.

The US dollar continues to play a dominant role, particularly in trade finance payments and forex reserves. In a speech at @Stanford, IMF’s @GitaGopinath discussed the impact of geopolitics on global trade and the dollar. https://t.co/ccSjFD0gvV pic.twitter.com/qkTI6dTS3B

— IMF (@IMFNews) May 8, 2024

Below is the full article…

Geopolitics and its Impact on Global Trade and the Dollar

Global economic ties are changing in ways we have not seen since the end of the Cold War.

After years of shocks—including the COVID-19 pandemic and Russia’s invasion of Ukraine—countries are reevaluating their trading partners based on economic and national security concerns. Foreign direct investment flows are also being re-directed along geopolitical lines. Some countries are reevaluating their heavy reliance on the dollar in their international transactions and reserve holdings.

All of this is not necessarily bad. Given the recent history of events, policymakers are increasingly—and justifiably—focused on building economic resilience. But if the trend continues, we could see a broad retreat from global rules of engagement and, with it, a significant reversal of the gains from economic integration.

Let’s take a closer look at how far we have gone down that route already. New trade restrictions have increased sharply—more than tripling since 2019—while financial sanctions have also expanded. The geopolitical risk index has spiked in 2022 following Russia’s invasion of Ukraine.

And private sector concerns about fragmentation—gauged by the number of mentions in corporate earnings calls—have surged.

Despite these trends, there are not yet clear signs of deglobalization at the aggregate level. Since around the time of the global financial crisis, when the 1990s-early 2000s hyper-globalization came to an end, the ratio of goods trade to GDP has been roughly stable—fluctuating between 41 and 48 percent.

But under the surface, there are increasing signs of fragmentation. Trade and investment flows are being redirected along geopolitical lines.

For example, China’s share in U.S. imports declined by 8 percentage points between 2017 and 2023 following a flare-up in trade tensions. During the same period, the U.S. share in China’s exports dropped by about 4 percentage points.

And direct trade between Russia and the West collapsed following the invasion of Ukraine and subsequent sanctions on Russia.

What about the implications of geopolitics for trade relations more broadly?

Consider a world divided into three blocs: a U.S. leaning bloc, a China leaning bloc, and a bloc of nonaligned countries.

The average weighted quarter-on-quarter trade growth between U.S. leaning countries and China leaning countries during 2022Q2 – 2023Q3 was almost 5 percentage points lower than the average quarterly weighted trade growth during 2017Q1 – 2022Q1.

At the same time, quarterly growth in trade within blocs only saw a 2-percentage point drop.

On average in the period after Russia’s invasion of Ukraine, we see that trade and FDI between blocs declined by roughly 12 and 20 percent more than flows within blocs, respectively.

It is notable that these patterns are not driven uniquely by the U.S. or China and hold up even when you take these two countries out of the picture.

This begs a question: Why have we not seen an even bigger impact of de-coupling between geopolitical rivals on global trade?

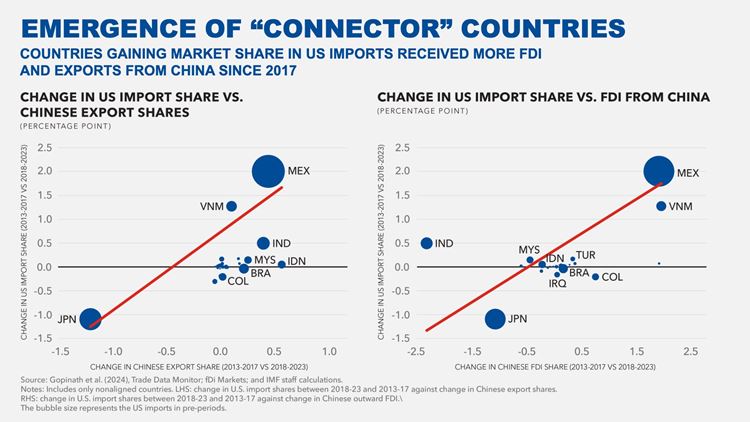

This is because some trade and investment are being re-routed through third-party countries, partially offsetting the erosion of direct links between the U.S. and China. Since 2017, greater Chinese presence in a country—measured either through exports or announced greenfield investment—has been associated with increased exports of that country to the U.S.

The emergence of these “connector” countries—perhaps most notably Mexico and Vietnam—may have helped cushion the global economic impact of direct trade decoupling between the U.S. and China. But whether it has helped to diversify exposures and increase supply chain resilience remains an open question.

The path forward will depend on policymakers. They may accept such rerouting of trade and FDI in order to preserve some of the gains of economic integration. Or they may continue to raise barriers for cross-border trade and investment, further breaking both direct and indirect links between politically distant countries.

How bad could it get?

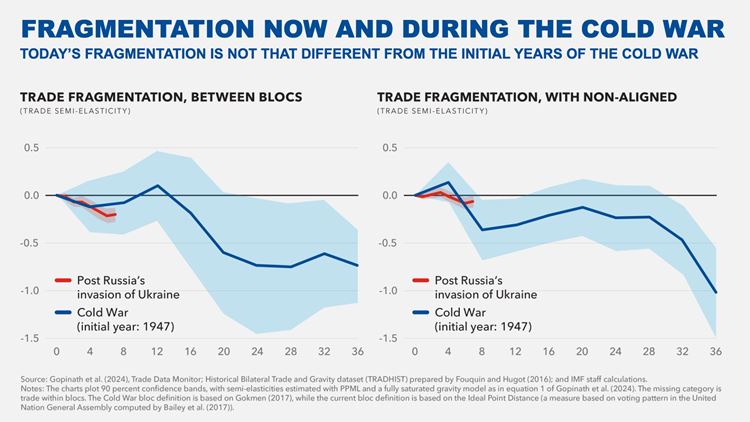

To gauge the potential magnitude of fragmentation along geopolitical lines, let’s compare the current trade fragmentation with that of the Cold War period.

Trade between the rival Western and Eastern blocs was significantly depressed during the Cold War, relative to trade within these blocs.

Thus far, today’s fragmentation is not significantly different from the initial years of the Cold War. However, compared to the average “between-bloc trade shortfall” during the entire Cold War period, fragmentation so far is an order of magnitude smaller.

But there is still cause for concern. Trade fragmentation is much more costly this time around because unlike the start of the Cold War when goods trade to GDP was 16 percent, now that ratio is 45 percent. Moreover, while back then countries within a bloc were taking off trade restrictions, now we are in an environment of growing protectionism with several countries turning inward.

The potential role of non-aligned countries in the current trade frictions also makes the situation today different from the Cold War experience. The evidence suggests such countries did not play an important role serving as connectors between rival blocs during the Cold War—likely because they had a much smaller economic footprint and global supply chains were not yet developed. Today, they have greater economic and diplomatic heft and are much more integrated into the global economy. Their role as connectors this time round can help attenuate some of the costs of fragmentation.

Have geopolitical tensions and the shifting patterns of trade and FDI affected the currency composition of cross-border payments and FX reserves?

Data on currency use in international trade and finance is sparser and comes with longer lags than trade figures. Even so, we are so far not seeing a significant impact. Despite increased geopolitical risks, the latest data show that the U.S. dollar remains dominant. According to SWIFT, it accounts for over 80 percent of trade finance, likely because much of commodity trade continues to be invoiced and settled in dollars.

It also accounts for nearly 60 percent of FX reserves despite the gradual diversification of FX reserves away from the dollar and partly into non-traditional reserve currencies such as the Australian dollar, and the Canadian dollar.

Given the reshaping of trade relations, has the currency composition of trade finance changed during 2022-23?

The answer is not much for U.S.-leaning countries, but there have been more visible changes for China-leaning countries.

For the China bloc, the USD share of trade finance payments has declined since early 2022. At the same time, the RMB share has more than doubled, from around 4 percent to 8 percent.

This is not a Russia only story. In fact, the share of RMB in trade finance for the China bloc would be only slightly lower if Russia were excluded from it. Most RMB denominated trade finance captured in the SWIFT data reflects transactions between China and China leaning countries.

For China, the share of RMB in all cross-border transactions of Chinese non-bank entities with foreign counterparts was close to zero 15 years ago but has risen to reach around 50 percent in late 2023. In contrast, the USD share has been on a declining trend, falling from around 80 percent in 2010 to 50 percent in 2023.

The increasing use of the RMB may have been supported by the Cross-Border Interbank Payments System (CIPS)—a system launched by the People’s Bank of China which offers clearing and settlement services for cross-border transactions in RMB.

Looking at global FX reserves, the most notable development during 2022-23 has been an increase of gold purchases by central banks.

Gold is generally viewed as politically neutral safe asset, which can be stored at home and be insulated from sanctions or seizure. It can also be an inflation hedge but cannot be easily used in transactions.

The share of gold in the FX reserves of the China bloc has been rising since 2015—a trend not exclusively driven by China and Russia. Importantly, during the same period, the share of gold in FX reserves of countries in the U.S. bloc has been broadly stable.

This suggests that gold purchases by some central banks may have been driven by concerns about sanctions risk. This is consistent with a recent IMF study[3] confirming that FX reserve managers tend to increase gold holdings to hedge against economic uncertainty and geopolitical including sanctions risk.

Looking at China, the share of gold in total FX reserves has increased from less than 2 percent in 2015 to 4.3 percent in 2023. During the same period, the value of China’s holdings of U.S. Treasury and Agency bonds relative to FX reserves has declined from 44 percent to about 30 percent. This reflects both net purchases and valuation effects.

The downward trend holds even if we account for the fact that some of China’s holdings of U.S. bonds may be held in Belgium (Euroclear), as some analysts suggest.[4]

If fragmentation deepens, what would be the economic cost? And how will those costs be transmitted?

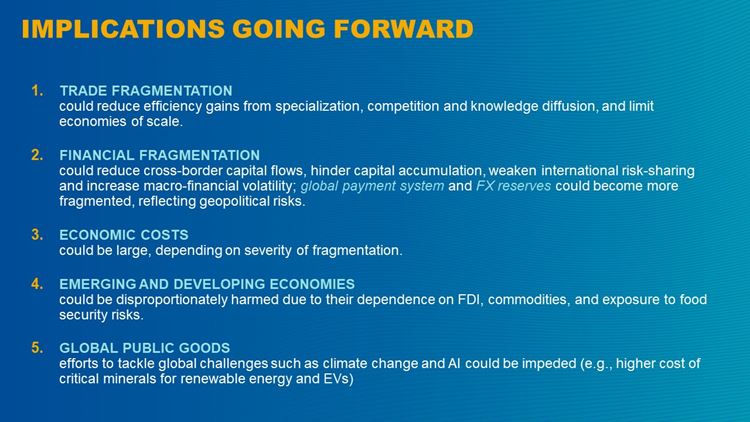

Trade is the main channel through which fragmentation could reshape the global economy. Imposing restrictions on trade would diminish the efficiency gains from specialization, limit economies of scale, and reduce competition. The capacity of trade to incentivize within-industry reallocation and generate productivity gains would be stifled. Less trade would also imply less knowledge diffusion, a key benefit of integration, which could also be reduced by fragmentation of cross-border direct investment. A useful example is Brexit. Because of the extensive interlinkages between Europe and the UK, Brexit is thought to have had a sizable negative effect on the UK economy.

There would also be costs from financial fragmentation. It would limit capital accumulation—because FDI would be reduced—and affect the allocation of capital, asset prices, and the international payment system. Financial fragmentation could also lead to weaker international risk sharing, resulting in higher macro-financial volatility for individual countries, and higher crisis risks due to idiosyncratic shocks[5]. The global payment system could become fragmented along geopolitical lines with the emergence of new payment platforms with limited or no interoperability. This could lower efficiency, and lead to fragmented standards and regulation.

In addition, FX reserves could be re-aligned to reflect new economic links and geopolitical risks. A global system with multiple reserve currencies could have several benefits, including a larger pool of safe assets and more opportunities for FX reserve diversification. But the stability of such a system would be at risk without strong policy coordination among all reserve currency issuing countries—including through a network of swap lines. This would not be possible if the world is divided along geopolitical lines.

The estimates of the economic costs of fragmentation vary widely and are highly uncertain. In a mild scenario with low adjustment costs, losses could be as low as 0.2% of world GDP, while in an extreme trade fragmentation scenario with limited ability of economies to adjust, losses could be as high as 7 percent of global GDP. As for foreign direct investment, fragmentation in a world divided into two blocs centered around the U.S. and China with some countries remaining non-aligned could result in long term losses of around 2 percent of global GDP.

Some countries could benefit from fragmentation in its mild forms. But if fragmentation worsens, they could be left with a larger slice of a much smaller pie. In short, everyone could lose.

Some emerging and developing economies could benefit from fragmentation in its mild forms as trade and FDI gets redirected towards them. However, as a group they would be disproportionately negatively impacted by more severe forms of fragmentation. These economies rely more on imports and exports of key products, including commodities, for which it is harder and more costly to find new markets and suppliers.

Our research suggests that low-income countries, on average, could experience 4 times the simulated global economic output loss of other countries in the event of fragmentation of commodity markets into two blocs. Most of the losses would be due to trade restrictions of agricultural commodities, as low-income countries are heavily dependent on agricultural imports to feed their populations, raising concerns about food security in poorer countries.

Furthermore, emerging markets and developing economies are heavily dependent on FDI from advanced economies, the main source of global investment. They would also be left without positive spillovers from FDI to local firms in the case of friend-shoring or reshoring, when FDI is relocated to “friendly” countries in the other bloc or home.

Fragmentation would also inhibit our efforts to address other global challenges that demand international cooperation. The breadth of these challenges—from climate change to AI—is immense.

Recent IMF analysis shows that fragmentation of trade in minerals critical for the green transition—such as copper, nickel, cobalt, and lithium—would make the energy transition more costly. Because these minerals are geographically concentrated and not easily substituted, disrupting their trade could lead to sharp swings in their prices, suppressing investment in renewables and EV production.

So, what can we do to prevent this? The ideal solution would be to preserve and strengthen the multilateral rules-based global trading system and the international monetary system.

Strengthening the trading system would require restoring a fully functioning WTO dispute settlement mechanism. It will also require making more progress on dealing with subsidies and national security trade restrictions and developing international rules and norms on the appropriate use and design of industrial polices.

To strengthen the international monetary system, concerted efforts are needed to prevent fragmentation of the global payment system and related standards and regulations. We also need to ensure a well-resourced and efficient global financial safety net, improve measurement and monitoring of cross-border crypto flows, and maintain global dialogue on debt restructuring.

But given where we are today, the ideal may be difficult to achieve. Therefore, we need pragmatic steps to rebuild trust.

The first step is to keep open the lines of communication and stay engaged. Dialogue between the U.S. and China—which we are now seeing—can help prevent the worst outcomes from occurring.

Non-aligned countries can also play a bigger role—using their economic and diplomatic heft to keep the world integrated.

The second pragmatic step is to work together on areas of common interest. Take climate, for example. Over 70 countries have come together through the WTO’s Trade and Environmental Stability Structured Discussions to identify opportunities to promote the trade of renewable energy goods and services.

We also see progress in services and digital trade. Policy restrictions are high in these fast-growing areas of the global economy. But recognizing this, 90 countries representing more than 90 percent of global trade are working together toward common digital trade rules.

And 71 members came together around a WTO plurilateral agreement on Services Domestic Regulation that aims to promote more transparent, predictable, and efficient regulatory frameworks and is expected to reduce services trade costs by USD 127 billion.

In addition, the G20 is working on interlinking cross-border payment systems, aiming to improve efficiency and reduce transaction costs.

The third step is to limit harmful unilateral policy actions—including industrial policies. While it is appropriate to try to correct market failures through policy interventions, it must be carefully handled. Politically, industrial policies may be hard to limit or roll back given their concentrated benefits and diffused costs. History is replete with cautionary tales of policy mistakes, high fiscal costs & negative spillovers to other countries. Internationally, such policies have led to retaliation, which would deepen fragmentation.

Adhering to existing legal frameworks is also critical for maintaining trust between countries and in the international monetary system.

For example, many countries are following closely the ongoing discussion about potential use of Russian state assets, including reserves of the Bank of Russia, to support Ukraine. While this is for relevant courts and jurisdictions to determine, for the IMF, it is important that any action has sufficient legal underpinnings and does not undermine the functioning of the international monetary system.

While rebuilding trust is difficult and may take time, it is critical to avoid the worst outcomes in a rapidly fragmenting world. It is well worth it to preserve some of the enormous gains from economic integration that have made the world more prosperous and more secure.